What's premium for the US economy is pullback for the investor.... We knew it was coming - here's Joseph Wang on March 31, 2025:

"Revenue Side

The Administration's overall revenue goals suggest that Liberation Day will unveil tariffs that are both large and persistent. Officials have guided towards a goal of a reducing the fiscal deficit from 6% to 3%, which implies a $2t deficit reduction. Recent communication suggests half of this amount will come from austerity, and the balance from higher revenue. Secretary Lutnick has proposed golden visas, tax reform, and tariff revenue as the three primary mechanisms to raise $1t a year. This suggests that the heavy lifting will have to come from tariffs, which would also be in line with many sizable sector tariffs recently announced. This post walks through the revenue raising plan and suggests the market is still not fully prepared for the structural shifts planned by the Administration."

For a long term saver, such as someone in their 30s, saving for some medium term projects, but basically investing for retirement, they just keep on ploughing in their monthly amount (but don't put your lottery winnings in just at the moment!), and no need to be disturbed by this downturn.

For someone in retirement, it's not quite the same picture. Capital preservation is the order of the day, because this determines what can be withdrawn over the medium term (the 4% rule).

The surprise for most people in this latest pullback was how the dollar devalued by almost 2% whilst Trump was talking.

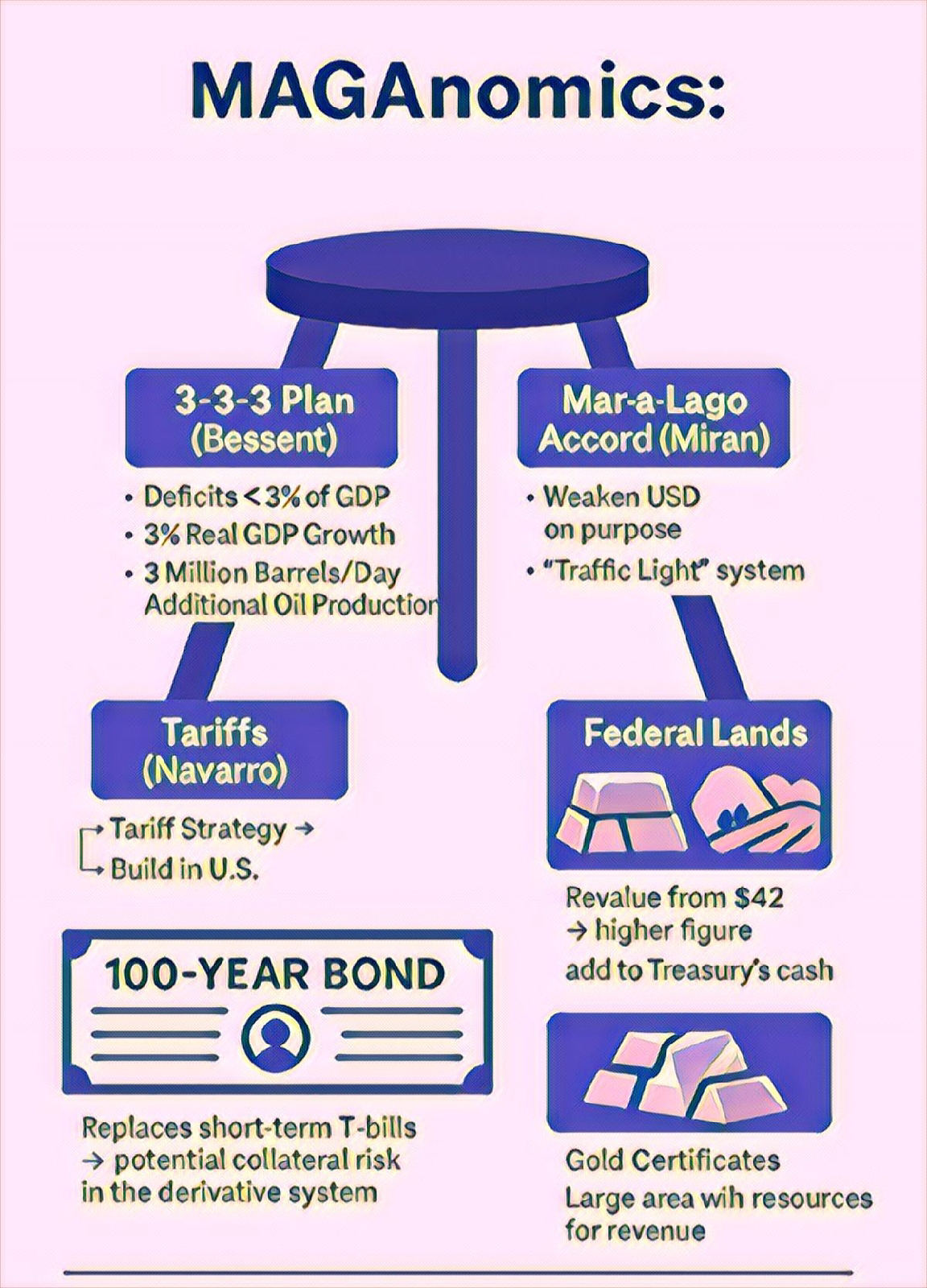

This is a bit of a fork in the road because maganomics calls for a weaker dollar, but the dollar milkshake theory (which I will finish off writing about...) says the dollar will go higher ...until the final reckoning in a few years out of course, when the US dollar loses its reserve status.

It is simply not possible to call market highs and lows, but if you go back to 12 Feb - see my blog post of the 12 Feb "this is behind my feeling that markets have topped" - then there's been a 12% pullback ... with another 20 to 30 percent to come... who knows? Keep in mind that the US market is still well over valued. For an exceptional example, Tesla is on a P/E of 100.

The least that can be said is that we are risk off while Trump is fixing the economy ie implementing his maganomics strategies.

Think like a businessman. Trump is a pretty versatile character, but at base he is a businessman.

Kaplan and Norton

"The Execution Premium"

The balance sheet, the P&L and cash flow are king, big ideas and clever strategies are fine, but success is all in the execution. Ie how you turn strategies into programs of work and roll them out into operations.

What is premium for the US economy is pullback for us. "Short term pain."

0 comments:

Post a Comment

Keep it clean, keep it lean