|

Main topics are life and times in S E Asia, investing and making a steady income out of the stock exchange, brexit-an old topic now, covid-another old topic

-

6 December 2024 Propaganda https://notebooklm.google.com/notebook/2944804a-e048-4ef4-a33b-b6c89a6b3fa6/audio

-

Georgia’s Crisis: Is the West Backing Regime Change? Georgia is facing yet another geopolitical storm, as protests in Tbilisi against the de...

Search This Blog

Powered by Blogger.

YOUR INVESTMENT STRATEGY

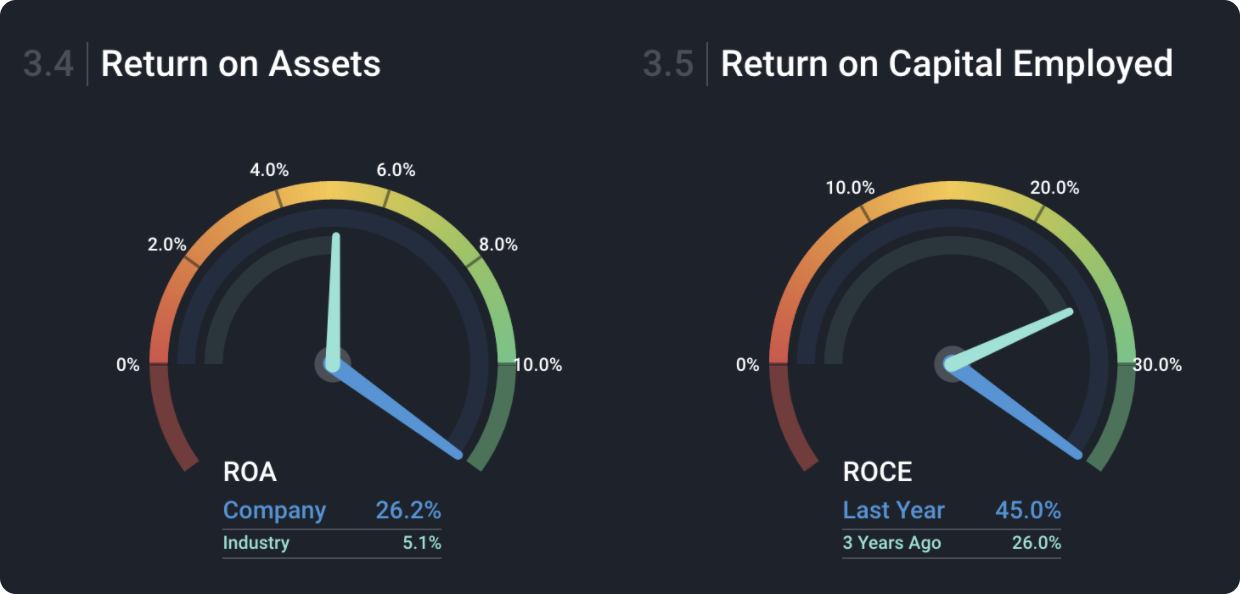

10 April 2025 YOUR INVESTMENT STRATEGY Your investment strategies are clear - for short-term projects such as saving for a dep...

Labels

- ##Ukraine

- #Aero

- #AI

- #America

- #Architecture

- #art

- #Bali

- #BookReview

- #Brexit

- #Britain

- #Byzantium

- #ChangeManagement

- #ChiangMai

- #China

- #ClimateChange

- #Comedy

- #CommunicationSkills

- #Conservatism

- #Constitution

- #Coronavirus

- #covid

- #Cuisine

- #Culture

- #Cyprus

- #Debt

- #Democracy

- #Devolution

- #DigitlNomad

- #DIY

- #DollarMilkshake

- #Economics

- #economy

- #Economy #IR #Ukraine

- #Election

- #Elections

- #Elections #Economics

- #Empire

- #Euro

- #Europe

- #Family

- #France

- #France #Algeria #IR

- #Friends

- #funnylife

- #Gaza

- #Geo

- #Geopolitics

- #Gold

- #Governance

- #Government

- #Health

- #HealthAndWellness

- #History

- #House

- #Housing

- #InteriorDesign

- #invest

- #Invest #Maganomics

- #Investing

- #Investment

- #IR

- #IR @IR

- #IR #Ukraine

- #Iraq

- #Islam

- #Israel

- #IT

- #Language

- #Legal

- #Leisure

- #Literature

- #London

- #Love

- #Macron

- #MAGA

- #Mali

- #Marketing

- #Mathematics

- #ME

- #Media

- #MiddleEast

- #MSM

- #Music

- #Nationalism

- #NATO

- #Nature

- #Neocons

- #NewWorldOrder

- #Noël

- #Nuclear

- #Organisation

- #PaleSteen

- #Palestine

- #Perso

- #Personal

- #Personal finance

- #Philosophy

- #Politics

- #Populism

- #Presidential

- #Propaganda

- #Property

- #Psychology

- #Rehab

- #Religion

- #Reset

- #Retail

- #Revelation

- #Russia

- #Scexit

- #Scotland

- #SEAsia

- #Society

- #Society #Media

- #Sociology

- #Spiritual #Philosophy

- #Strategy

- #SupplyChainLogistics

- #SurveillanceState

- #Taiwan

- #Tech

- #Thailand

- #the West

- #TheGreatReset

- #Tourism

- #Travel

- #Trump

- #UK

- #UK politics

- #UKPolitics

- #Ukraine

- #Ukraine #Armenia

- #Ukraine #IR

- #USElections

- #Woke

- #Work

- #WorldWar

- #WW3

- US National Debt

Blog Archive

-

▼

2021

(164)

-

▼

September

(23)

- IS IT ACCURATE TO LABEL COMMUNISTS AS "FASCIST"?

- ANOTHER ESSAY ON "HOW TO PICK LONGER TERM STOCK MA...

- MAPS OF MEANING : THE ARCHITECTURE OF BELIEF

- A VINDY DAY - ALL ABOUT VINDALOO

- WOULD THE PEOPLE OF NORTHERN IRELAND VOTE TO STAY ...

- THAILAND : IDEAL ENTRY REQUIREMENTS

- STOCK MARKETS MELTING?

- AUKUS. THIS IS THE DEAL AND THE FRENCH ARE TOAST

- OUR FREEDOMS

- FRENCH SUBS, WOUNDED PRIDE

- IS IT TIME TO REFORM DEMOCRACY?

- THE ROLE OF THE FATHER (IT IS SELFLESS & GIVING)

- CHIANG MAI BACK IN WORLD'S TOP TEN HOLIDAY DESTINA...

- THE NEED FOR FURTHER REFORM OF THE NHS

- BORIS, THE WACAMOLE POLITICIAN

- WOULD YOUR HARD-EARNED FARE BETTER IN PROPERTY OR ...

- HOW TO INVEST WHEN YOU’VE RETIRED

- POLITICAL BELIEFS

- HOW TO STAY IN POWER FOREVER

- HOW TO DEAL WITH VACCINE REFUSENIKS

- NOTES ON THE WITHAWAL AGREEMENT

- PROBLEMS WITH DEMOCRACY

- PROPERTY OWNERSHIP IN ASIA : CHINA

-

▼

September

(23)

Blogger templates

Blogroll

Categories

- ##Ukraine (1)

- #Aero (2)

- #AI (4)

- #America (1)

- #Architecture (2)

- #art (5)

- #Bali (4)

- #BookReview (1)

- #Brexit (13)

- #Britain (1)

- #Byzantium (1)

- #ChangeManagement (1)

- #ChiangMai (1)

- #China (4)

- #ClimateChange (1)

- #Comedy (1)

- #CommunicationSkills (3)

- #Conservatism (1)

- #Constitution (1)

- #Coronavirus (5)

- #covid (5)

- #Cuisine (10)

- #Culture (5)

- #Cyprus (1)

- #Debt (1)

- #Democracy (4)

- #Devolution (1)

- #DigitlNomad (5)

- #DIY (1)

- #DollarMilkshake (1)

- #Economics (26)

- #economy (13)

- #Economy #IR #Ukraine (1)

- #Election (1)

- #Elections (22)

- #Elections #Economics (1)

- #Empire (1)

- #Euro (1)

- #Europe (10)

- #Family (1)

- #France (5)

- #France #Algeria #IR (1)

- #Friends (1)

- #funnylife (1)

- #Gaza (1)

- #Geo (1)

- #Geopolitics (2)

- #Gold (6)

- #Governance (1)

- #Government (1)

- #Health (6)

- #HealthAndWellness (1)

- #History (1)

- #House (1)

- #Housing (3)

- #InteriorDesign (3)

- #invest (40)

- #Invest #Maganomics (1)

- #Investing (2)

- #Investment (1)

- #IR (92)

- #IR @IR (1)

- #IR #Ukraine (3)

- #Iraq (1)

- #Islam (1)

- #Israel (3)

- #IT (1)

- #Language (1)

- #Legal (1)

- #Leisure (1)

- #Literature (1)

- #London (1)

- #Love (1)

- #Macron (2)

- #MAGA (1)

- #Mali (1)

- #Marketing (1)

- #Mathematics (1)

- #ME (2)

- #Media (1)

- #MiddleEast (3)

- #MSM (1)

- #Music (4)

- #Nationalism (1)

- #NATO (1)

- #Nature (1)

- #Neocons (1)

- #NewWorldOrder (1)

- #Noël (1)

- #Nuclear (1)

- #Organisation (1)

- #PaleSteen (1)

- #Palestine (2)

- #Perso (1)

- #Personal (2)

- #Personal finance (1)

- #Philosophy (4)

- #Politics (7)

- #Populism (1)

- #Presidential (1)

- #Propaganda (6)

- #Property (1)

- #Psychology (3)

- #Rehab (2)

- #Religion (1)

- #Reset (1)

- #Retail (1)

- #Revelation (4)

- #Russia (6)

- #Scexit (5)

- #Scotland (1)

- #SEAsia (3)

- #Society (33)

- #Society #Media (1)

- #Sociology (1)

- #Spiritual #Philosophy (1)

- #Strategy (1)

- #SupplyChainLogistics (2)

- #SurveillanceState (1)

- #Taiwan (2)

- #Tech (1)

- #Thailand (8)

- #the West (1)

- #TheGreatReset (1)

- #Tourism (1)

- #Travel (1)

- #Trump (2)

- #UK (5)

- #UK politics (2)

- #UKPolitics (1)

- #Ukraine (126)

- #Ukraine #Armenia (1)

- #Ukraine #IR (2)

- #USElections (1)

- #Woke (1)

- #Work (1)

- #WorldWar (1)

- #WW3 (2)

- US National Debt (1)

-

Blog Archive

- April 2025 (8)

- March 2025 (19)

- February 2025 (16)

- January 2025 (10)

- December 2024 (15)

- November 2024 (17)

- October 2024 (21)

- September 2024 (17)

- August 2024 (23)

- July 2024 (28)

- June 2024 (25)

- May 2024 (12)

- April 2024 (21)

- March 2024 (25)

- February 2024 (14)

- January 2024 (7)

- December 2023 (9)

- November 2023 (8)

- October 2023 (16)

- September 2023 (13)

- August 2023 (17)

- July 2023 (28)

- June 2023 (10)

- May 2023 (16)

- April 2023 (12)

- March 2023 (7)

- February 2023 (8)

- January 2023 (17)

- December 2022 (11)

- November 2022 (15)

- October 2022 (12)

- September 2022 (14)

- August 2022 (20)

- July 2022 (14)

- June 2022 (21)

- May 2022 (16)

- April 2022 (15)

- March 2022 (19)

- February 2022 (14)

- January 2022 (13)

- December 2021 (13)

- November 2021 (12)

- October 2021 (24)

- September 2021 (23)

- August 2021 (16)

- July 2021 (12)

- June 2021 (13)

- May 2021 (17)

- April 2021 (13)

- March 2021 (21)

-

Labels

- ##Ukraine

- #Aero

- #AI

- #America

- #Architecture

- #art

- #Bali

- #BookReview

- #Brexit

- #Britain

- #Byzantium

- #ChangeManagement

- #ChiangMai

- #China

- #ClimateChange

- #Comedy

- #CommunicationSkills

- #Conservatism

- #Constitution

- #Coronavirus

- #covid

- #Cuisine

- #Culture

- #Cyprus

- #Debt

- #Democracy

- #Devolution

- #DigitlNomad

- #DIY

- #DollarMilkshake

- #Economics

- #economy

- #Economy #IR #Ukraine

- #Election

- #Elections

- #Elections #Economics

- #Empire

- #Euro

- #Europe

- #Family

- #France

- #France #Algeria #IR

- #Friends

- #funnylife

- #Gaza

- #Geo

- #Geopolitics

- #Gold

- #Governance

- #Government

- #Health

- #HealthAndWellness

- #History

- #House

- #Housing

- #InteriorDesign

- #invest

- #Invest #Maganomics

- #Investing

- #Investment

- #IR

- #IR @IR

- #IR #Ukraine

- #Iraq

- #Islam

- #Israel

- #IT

- #Language

- #Legal

- #Leisure

- #Literature

- #London

- #Love

- #Macron

- #MAGA

- #Mali

- #Marketing

- #Mathematics

- #ME

- #Media

- #MiddleEast

- #MSM

- #Music

- #Nationalism

- #NATO

- #Nature

- #Neocons

- #NewWorldOrder

- #Noël

- #Nuclear

- #Organisation

- #PaleSteen

- #Palestine

- #Perso

- #Personal

- #Personal finance

- #Philosophy

- #Politics

- #Populism

- #Presidential

- #Propaganda

- #Property

- #Psychology

- #Rehab

- #Religion

- #Reset

- #Retail

- #Revelation

- #Russia

- #Scexit

- #Scotland

- #SEAsia

- #Society

- #Society #Media

- #Sociology

- #Spiritual #Philosophy

- #Strategy

- #SupplyChainLogistics

- #SurveillanceState

- #Taiwan

- #Tech

- #Thailand

- #the West

- #TheGreatReset

- #Tourism

- #Travel

- #Trump

- #UK

- #UK politics

- #UKPolitics

- #Ukraine

- #Ukraine #Armenia

- #Ukraine #IR

- #USElections

- #Woke

- #Work

- #WorldWar

- #WW3

- US National Debt

-

About

Copyright © 2025

Living in the air | Powered by Blogger

Design by FlexiThemes | Blogger Theme by Lasantha - PremiumBloggerTemplates.com | NewBloggerThemes.com

0 comments:

Post a Comment

Keep it clean, keep it lean