But you see, Communists *are* fascist. Communism is the dictatorship

of the proletariat, it is where the State is more important than the

individual, it is intolerant of opposition, it employs violence on its

own people.We say that Nazis were National

Socialists and then Fascists, true, so nation is important, aswhere

Communism is international.But that's what we are getting

at - denial of free speech is unscientific, against the spirit of

rational open-minded inquiry, it is unenlightened ...well, that is true of all utopianists,

religious...

Tuesday, 28 September 2021

ANOTHER ESSAY ON "HOW TO PICK LONGER TERM STOCK MARKET WINNERS"

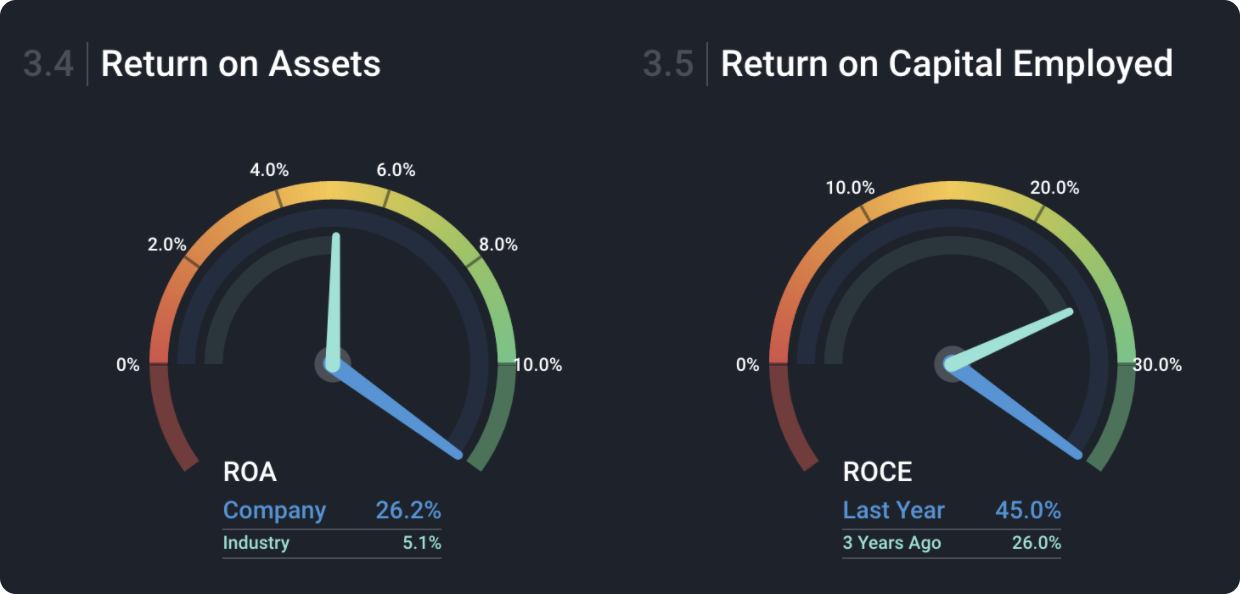

Cape 28 September 2021If we do decide to allocate our capital to stocks, this then raises some follow-on questions: What stocks should we buy? How can we assess their strength? Do they have any weaknesses? What are their future prospects like? Will they be able to handle an inflationary environment?You might know that our philosophy at Simply Wall St is to not try to predict where the market is going or what will happen next in the...

Monday, 27 September 2021

MAPS OF MEANING : THE ARCHITECTURE OF BELIEF

Cape 27 September - Jordan Peterson 'Maps of Meaning"Why have people from different cultures and eras formulated myths and stories with similar structures? What does this similarity tell us about the mind, morality, and structure of the world itself? Jordan Peterson offers a provocative new hypothesis that explores the connection between what modern neuropsychology tells us about the brain and what rituals, myths, and religious stories...

A VINDY DAY - ALL ABOUT VINDALOO

Cape 27 September 2021Here is a little peek into the history of Vindaloo - a classic dish that has strong European influence. It took elements from the Portuguese and English cuisine to create something uniquely Indian. It is an Indianised version of a popular Portuguese dish Carne de vinha d'alhos (the Portuguese version of Boeuf Bourguignon or Irish Stew with Guinness if you prefer) in which meat is marinated in wine...

Sunday, 26 September 2021

WOULD THE PEOPLE OF NORTHERN IRELAND VOTE TO STAY IN THE UNION?

Cape 25 Sep 2021Of the 18 MPs elected in 2019 in Northern Ireland to the UK

Parliament, 9 nine are Irish Nationalists, 8 eight are Unionist and 1 one is unaligned.7 Seven of the Nationalists won't take up their seats at Westminster as

they don't acknowledge the legitimacy of British rule. All 5 five of the border constituencies returned Irish Nationalist MPs. 3 Three of the 4 four Belfast constituencies elected Irish Nationalists.But...

Friday, 24 September 2021

THAILAND : IDEAL ENTRY REQUIREMENTS

1. Lateral flow is sufficient for fully vaccinated visitors. Why? Testing is not really needed once the population is vaccinated, but until then a pre-flight LFT is sufficient.2. No quarantine for fully vaccinated. Why? Because any positives are eliminated at pre-flight test.3. No covid insurance. Why? They are never hospitalised for covid (if comorbidities, it can be a different story).4. Many changes can be made to simplify the permission to stay.5. A credible plan to restore and enhance the tourist sector, "build back better" applies to infrastructure...

Monday, 20 September 2021

STOCK MARKETS MELTING?

Yes, there's 1. this Chinese property collapse 300billion$ - lots of Chinese bought off-plan and will be really angry, -then there's the supply chain all those companies working for Evergrande who could go bust,-then there's all the debt and interest that banks might not get back so they won't have money to lend (this is called a "credit crunch") and so many companies will not be able to borrow, no start up, no grow.Will...

Sunday, 19 September 2021

AUKUS. THIS IS THE DEAL AND THE FRENCH ARE TOAST

Of course the French reaction can be the result of jealousy: fear of loss. Except here, the loss has materialised.

In

fact, we see the authentic hurt pride of the French: they thought they

had something to be proud of, but their subs were rejected. And we see

the hubristic hurt pride of Macron: his sense of his self-importance is

punctured.

Reality is, the Astralians asked for nuclear subs from the UK and...

OUR FREEDOMS

In case we forget, our freedoms are longstanding and many, notably freedom from false arrestthe right to an unbiased jury trial in serious casesfreedom of speech, the

press and mediafreedom of religious

worship or to dissentfreedom to give the government the boot every

4-5 years, Brexit as reassuring proof of that even when the establishment spent four years opposing the popular vote and the losers leave with good grace, and do not call in the

military to overturn a democratically determined result. &nb...

FRENCH SUBS, WOUNDED PRIDE

The French reaction is one of wounded pride. It could be that they

thought they had something of worth (the subs), but no, the subs were

found to be inadequate, not up to the mark. That would be an authentic

pride, wounded. But it could a hubristic pride. This would

be from narcissistic arrogance and self-importance (a known French

character weakness) which often precedes disaster.After all,

it has been well known for...

Tuesday, 14 September 2021

IS IT TIME TO REFORM DEMOCRACY?

Actually, it is time to requalify voters. Democracy is broke.

Try : property owners, over 26 years of age, under 26 BMI.14 Sep 2021&nb...

THE ROLE OF THE FATHER (IT IS SELFLESS & GIVING)

You can say that God has given us each a role or roles, as well as special gifts, to use for the benefit of others.

Now you mentioned the Greek myths. They teach us the importance of bravery, intelligence, and tell us about right and wrong. They show that we can be rewarded or punished for our good actions or our missteps.

You also mentioned "love". The father loves his wife and his children. But love is not so much a condition (I am...

CHIANG MAI BACK IN WORLD'S TOP TEN HOLIDAY DESTINATIONS

https://www.tatnews.org/2021/09/worlds-best-awards-2021-names-bangkok-and-chiang-mai-among-the-globes-top-10-destinations/‘World’s Best Awards 2021’ names Bangkok and Chiang Mai among the globe’s top 10 destinationsBangkok, 13 September, 2021 – The Tourism Authority of Thailand (TAT) is pleased to report that Thailand has performed well in the ‘World’s Best Awards 2021’ survey by Travel + Leisure, with destinations and hotels being...

THE NEED FOR FURTHER REFORM OF THE NHS

Many of us remember the restructuring that created a new body, NHS

England, to run the health service, set up new regulators, to replace

primary care trusts with clinical commissioning groups (CCGs) led by GPS, to

organise local services, and which handed responsibility for citizens' healthy lifestyles over to the town halls. Then in 2015, health visitors moved into local government as well, to complete the transfer of public...

Sunday, 12 September 2021

BORIS, THE WACAMOLE POLITICIAN

Boris is a wacamole politician. No strategy, all expediency and tactics."There, that'll sort you out once and for all. Now don't come back and annoy us again.""Next please!".

The

same collectivist policies are being applied across democracies

worldwide. It is not just "Bunter", as people here like to call him,

it's everywhere. The

problem is somewhere halfway between democracy and Liberal

internationalism, with the...

WOULD YOUR HARD-EARNED FARE BETTER IN PROPERTY OR STOCKS?

https://www.telegraph.co.uk/investing/buy-to-let/buy-to-let-property-vs-stocks-shares-best-invest-50k/?li_source=LI&li_medium=liftigniter-rhrInvest in property or shares?Buy-to-let property vs stocks and shares: where is best to invest £50k?Would your cash fare better in the property or stock market?By Rachel Mortimer 8 September 2021 • 6:00amilloIn the not-too-distant past, regulatory red tape and punishing tax changes sounded the death knell for the buy-to-let market as landlords sold up and left.But the sector has enjoyed an unexpected recent...